18 Sep Section 179: A Powerful Tax Incentive

Not sure what business expenses qualify as a tax deduction for your eye care practice? The clock is ticking away to take advantage of Section 179 tax deductions for 2023.

Don’t let the words taxes, deductions, and depreciation cause you to panic. If you plan to or have purchased (or leased) ophthalmic diagnostic equipment, office equipment, computers, office furniture, or optometry or ophthalmology software before the end of the year, check out our FAQs to learn more.

What are Section 179 deductions?

Section 179 of the IRS code benefits small or medium-sized businesses. Instead of deducting a portion of the qualified capital expenses or expenditures over the term of an asset’s useful life, you can deduct the full purchase price in the first year up to certain limits and thresholds.

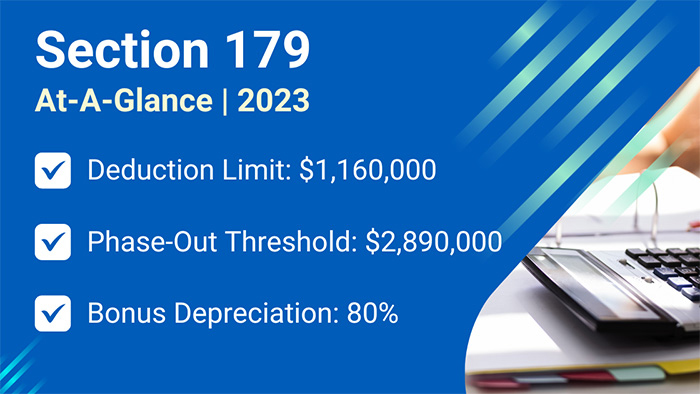

For example, in 2023 (taxes filed in 2024), the maximum deduction for Section 179 is $1,160,000, with a phase-out threshold of $2,890,000 and a bonus depreciation of 80% for qualifying expenses you put into use between January 1 and December 31, 2023. The bonus depreciation percentage will decrease in the following years until it reaches zero in 2027.

What are the IRS requirements for Section 179 deductions?

The IRS has two requirements for Section 179 deductions:

- The qualifying expense must be tangible, depreciable, and used for business.

- You must purchase and put the property into service in the year you claim the deduction. For instance, if you purchase or lease computer software on December 28, 2023, and don’t start using it in your practice until January 3, 2024, you cannot deduct this expense using Section 179 in 2023.

How do you estimate the Section 179 tax savings?

Section179.org has an easy-to-use calculator that will help you estimate your tax savings for 2023. However, always consult your accountant or tax professional for tax deduction advice for your eye care practice.

What type of off-the-shelf computer software qualifies for Section 179?

Off-the-shelf computer software, such as MaximEyes.com EHR and practice management software you put into service at your optometry or ophthalmology practice, qualify for the Section 179 deduction. Other software applications, such as Microsoft® Office 365, Adobe® Creative Cloud®, or Google® Workspace, also qualify.

What types of equipment or tangible personal property qualifies for Section 179?

The following new and used equipment or tangible personal property qualifies for the Section 179 deduction (this is not a complete list). Please refer to the IRS website for more information on what property qualifies and how to depreciate the property.

- Ophthalmic diagnostic equipment

- Office furniture

- Office equipment

- Servers

- Computers

- Laptops

- Tablets

- Printers

- Scanners

- Routers

- Fax machines

- Copiers

What is the Section 179 “50% business-use” requirement?

To qualify for the Section 179 deduction, you must use the equipment, software, and/or other qualified property for business purposes more than 50% of the time in the year you place it into service. For more information, visit the IRS website (business-use requirement section).

What IRS form do you need to complete for Section 179?

You must complete Part 1 (Election to Expense Certain Property) of the 2023 IRS Depreciation and Amortization Form 4562 to claim your deduction for Section 179. Attach the form to your tax return. Note: Form 4562 for 2023 is not yet available from the IRS at the posting of this blog.

Do you need to keep detailed records?

You must keep detailed records of any software, equipment, and personal, tangible property you leased or purchased during the year. Track where you purchased the property, the date you started using it, and all costs associated with the purchase (such as shipping, setup, etc.).

When does Section 179 expire for 2023?

Section 179 for the 2023 tax year will expire on December 31, 2023. Remember, you must purchase and put the qualified software, equipment, and other tangible personal property into use before midnight on December 31, 2023 to qualify.

Invest in Optometric Software That Benefits Your Business

At First Insight, a successful EHR and practice management system installation starts by understanding your objectives and long-term business needs. We get it; running a busy, profitable eye care practice is never easy. This is why technology is so important to support your practice.

Ready to make your office more efficient with MaximEyes.com and reap the rewards of Section 179 before the clock stops ticking for 2023? Request more information or schedule a quick introductory phone call.

Important: Always consult your accountant or tax professional for tax deduction advice for your eye care practice. First Insight does not guarantee that you will qualify for tax deductions, only that Section 179 allows certain tax deductions for qualifying businesses. For more information about Section 179, refer to the IRS Publication 946 website.