04 Oct Integrated Payment Solutions to Protect Your Business Security

Ensuring your eye care business complies with payment security standards and uses compliant integrated payment processing solutions for credit and debit card transactions must be a high priority.

Once that is understood, you must ask yourself, does the payment solution I use have point-to-point encryption, PCI-DSS compliance, and EMV technology to protect me from preventing fraud? How do these payment security terms impact my optometry and ophthalmology business?

Learn more about protecting your eye care business from payment security threats with compliant payment solutions.

Protect Your Business from Security Risks, Hacks and Fraud

Over three-quarters of small and medium-sized businesses (SMBs) don’t think they’re at any payment security risk. Yet, according to research conducted by Worldpay, an alarming majority of data breaches target small businesses.

The 2020 US Consumer Behavior Report by Worldpay states that 63% of US consumers were concerned that their card data would be hacked during a transaction. The Data Breach Investigations Report from Verizon states that identity theft and fraud are persistent problems with cybercriminals. These concerns are why you should provide security-protected payment solutions to your customers when they do business with you.

7 Reasons You Need Fast, Reliable, and Secure Payments for Point-of-Sale Transactions

Collecting and posting payments with MaximEyes.com integrated payments, online bill pay, and advanced patient portal tools provide you and your patients with faster and more secure payment processing transactions. First Insight partners with Worldpay, an industry-leading global payment processing provider.

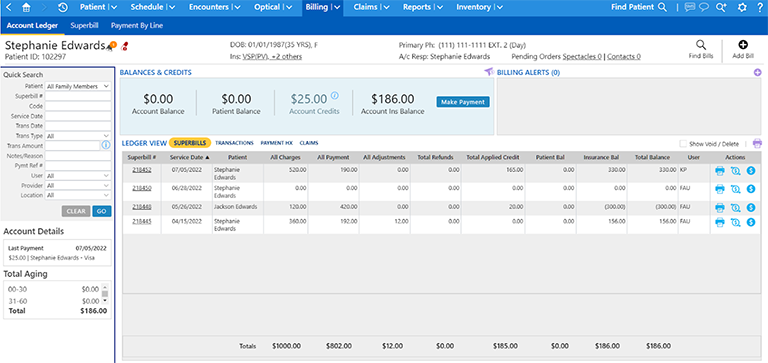

MaximEyes.com Account Ledger: Patient payment accepted and completed.

MaximEyes.com Account Ledger: Patient payment accepted and completed.

Below are 7 reasons you need an integrated payment solution for your eye care practice.

- Reduce duplicate accounting efforts. Easier reconciliation saves time and wages. There’s no need to match reports from the terminal and the point-of-sale (POS). Reports will automatically generate, allowing you to verify your authorized transactions securely.

- Speed up check-out with faster transactions. Running one transaction at the POS is faster than using both a terminal and a POS.

- Improve profitability with fewer errors and chargebacks. Keep patients happy and avoid chargebacks by reducing duplicate transaction input errors and the risk of incorrectly entered accounts.

- Get one-stop payment customer support. Eliminate time-consuming finger-pointing to solve payment processing issues. Customer support from our partner Worldpay Integrated Payments is available 24/7, so you get help when needed.

- Access secure payment processing tools. From chip card acceptance to end-to-point encryption, integrated payments offer the tools you need to combat fraud and protect your patients’ data and your practice.

- Reduce past-due balances with convenient online bill pay 24/7. Send the patient an SMS or email with a secure payment link to pay from their mobile device or at home for their outstanding balance.

- Communicate with patients via their patient portal. Worldpay online bill pay integrates with First Insight’s EyeClinic.net patient portal and MaximEyes.com. Eliminate data entry errors and get paid faster by sending text and email payment-due reminders to patients directly to their patient portal.

WATCH MAXIMEYES.COM INTEGRATED PAYMENT SOLUTIONS VIDEO

What is Point-to-Point Encryption?

Point-to-point encryption (P2PE) is a security protection solution that converts customer card details into meaningless code when the customer inserts, swipes, or taps their card into your card reader.

Any card information captured during the transmission of the transaction will immediately be encrypted, making it impossible for malicious hackers to solve and steal. Once the card information has reached a safe harbor, such as the bank, it will decrypt the meaningless code using a key to approve or decline the customer’s transaction.

Protecting your customers’ information and ensuring they feel safe doing business with you is your responsibility. P2PE is one of the safest payment solutions and is a standard established by the Payment Card Industry (PCI) Security Standards Council at the end of 2011.

According to a TechTarget article, one of the main benefits of point-to-point encryption is reducing the scope of security efforts. P2PE was created to give you peace of mind when your customers trust you with their sensitive information.

What is PCI-DSS Compliance?

Payment Card Industry Data Security Standard (PCI-DSS) is a set of industry-wide security requirements developed by major credit and debit card brands, such as Visa®, MasterCard®, Discover®, American Express®, and others. PCI-DSS helps protect the safety of data and ensures all businesses that process, store, and/or transmit card information maintain a secure environment.

If you accept or process credit and debit card payments, you must comply with the 12 PCI Data Security Standards set by the PCI Security Standards Council®. PCI security standards cover technical and operational system requirements and vary based on your eye care practice’s size and processing methods. Regardless of the practice size, you must be compliant at all times.

If you don’t comply with PCI security standards, this may lead to data breaches that result in fines, fees, and lost business. You must also ensure that your system network and devices that process, store, or transmit cardholder data are in full compliance.

What is EMV Technology?

EMV chip card processing is a standard based on smart card technology that helps protect your business from fraudulent use of payment cards at your point of sale. EMV also protects customer data and reduces counterfeit fraud in-store. EMV stands for “EuroPay®, MasterCard®, and Visa®,” which are the card networks that initiated the standards.

According to a study from Thales, globally, in 2020, 66.4% of payment cards were EMV chip-based. In the US, there was a 14.2% increase in EMV card-present transactions from 67.84% to 77.52% over 12 months. Counterfeit card fraud continues to decline, with more businesses using EMV cards and EMV-enabled POS terminals.

Related: 8 EMV Technology Payment Processing Security Questions & Answers

PCI and HIPAA Compliant Pro Tips

Assess your PCI-DSS compliance and security of your cardholder data and complete the PCI Security Standards Council Self-Assessment Questionnaire (SAQ).

The SAQ includes detailed questions about your business and an Attestation of Compliance certifying that you completed the SAQ and met the PCI council guidelines. The PCI Security Standards Council’s “Document Library” also provides many resources for PCI-DSS compliance.

Below are a few Pro Tips you must always adhere to for PCI and HIPAA compliance.

- Securely store all written credit or debit card numbers under lock and key from prying eyes.

- Monitor your payment processing hardware and safely secure it when not used.

- Choose a payment processor and payment solutions provider that offers PCI compliance assistance.

- Make sure the point-of-sale (POS) system/terminal you use to process payments meets the Payment Applications Data Security Standards (PA-DSS) enforced by the PCI Council.

- Never store protected health information (PHI) or medical procedure information in the invoice line items or comments section of payment transactions.

- If you use a gift card processing service with your payment processing vendor, check with the vendor if you need to enter into a Business Associate Agreement (BAA). Although HIPAA doesn’t require financial institutions or merchant processing services that process credit, debit, or other payment card transactions to enter into a BAA with a covered entity (healthcare provider), you may need to obtain a valid BAA if you use other services.

- Keep computers password-protected. Change passwords often, at least quarterly. Do not reuse passwords once you change them. Do not share or post your password—keep them in a secure location. Always log off or lock computer access when you leave, even if only for a moment.

Integrate Compliant Payment Processing with Your Eye Care Practice Management Software

An integrated payment processing solution that includes encryption, PCI compliance assistance, and EMV chip processing is the best way to avoid payment security threats and streamline credit and debit card transactions. Staying on top of privacy and security measures to ensure the ongoing protection of your data is a top priority at First Insight.

Contact us today for more information about MaximEyes.com, our all-in-one EHR, practice management, patient engagement, and optical point-of-sale solution. We’ll help you create an action plan and determine your potential return on investment.

Are you a current MaximEyes customer? Email insidesales@first-insight.com for more information on how to add Worldpay integrated payment solutions to your MaximEyes system. There are no additional fees to use the Worldpay integration within MaximEyes. However, you must have an “active contract” with Worldpay.

This blog is an educational resource and does NOT constitute legal HIPAA or PCI-DSS compliance advice. Eye care providers are responsible for taking the necessary steps to protect the confidentiality, integrity, and availability of protected health information and comply with payment processing security standards and HIPAA security and privacy rules.